Cryptocurrency investing includes more than just bitcoin and ether, but with over 10,000 tokens available to investors, how does one select which currencies to hold?

In a series of blog posts we will seek to outline the case for investing in a diversified portfolio for cryptocurrencies by exploring the concentration of the cryptocurrency market, the benefits of diversification, index construction and selection criteria designed to minimize risk. We will kick off the series with a discussion of the concentration of the cryptocurrency market.

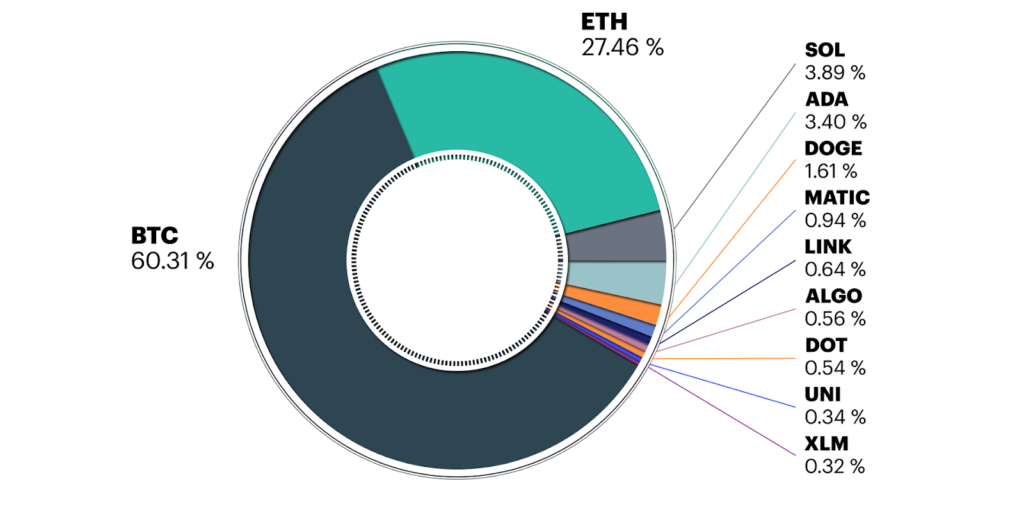

Historically cryptocurrency markets have been dominated by bitcoin which also has the distinction of being the oldest, largest and most widely known. Following its launch in 2015, ether quickly gained prominence and moved into the number two spot after only 6 months. Since the beginning of 2016 bitcoin and ether have dominated the cryptocurrency markets and the public discourse surrounding crypto investing.

As recently as March 2022, bitcoin and ether comprised nearly 90% of the cryptocurrency market. I think it’s important to clarify that we are focused solely on cryptocurrencies and have excluded stablecoins and asset backed tokens from this analysis.

Market capitalization:

Source: CF Benchmarks, as of March 1, 2022

The dominance of bitcoin and ether in cryptocurrency markets can be attributed to a number of factors but the foremost of which is the infancy of the space in general. The average age of all constituents in the index is only 5.75 years. When you remove the largest, that average age falls to only 4.75 years.

Each cryptocurrency network is supported by miners, node operators and users. Bitcoin, which is now over 13.5 years old, has had more than twice as much time as the average constituent to establish a network effect of participants. Since its inception, the bitcoins blockchain network has accumulated 37.5 million active non zero addresses. By comparison, the smallest constituent in the index which, coincidentally is the same age as the average age of all the index constituents, has accumulated only 130k active non zero addresses. (Source: Glassnode, July 18, 2022)

These smaller networks add diversification by gaining exposure to new and innovative technologies that strive to improve upon the existing experience users have in bitcoin or ether. While their technology is not as revolutionary as bitcoin, they are no less disruptive and can add diversification.

Tomorrow we will further expand on the benefits of diversification, even in an asset class that has experienced high historical correlations.

The products and services offered by Arxnovum are available to qualified investors in certain provinces and territories of Canada. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All investments contain risk and may lose value. Investing in the cryptocurrency market is subject to risks. Cryptocurrency, often referred to as “virtual currency” or “digital currency”, operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. Cryptocurrency operates without the oversight of a central authority or the banks and is not backed by any government. Even indirectly, cryptocurrencies such as bitcoin may experience high volatility, and related investment vehicles may be affected by such volatility. Cryptocurrency is not legal tender. Federal, state, provincial, territorial or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in North America is still developing. Cryptocurrency trading platforms may stop operating or permanently shut down due to fraud, technical glitches, hackers or malware, which could have an adverse impact on the net asset value per unit of the Fund. Please consult the Funds Term Sheet for a complete list of risks. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Arxnovum Investments Inc. and the portfolio manager believe to be reasonable assumptions, neither Arxnovum Investments Inc. nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.